Individuals

Employee Benefits Center

Visit the Employee Benefits Center to see current benefit options for your employer, as well as find claim forms, important phone numbers, and enrollment details. There’s no need to register for site access. Simply enter your employer’s name and select the correct one from the list to be directed to your Employee Benefits Center.

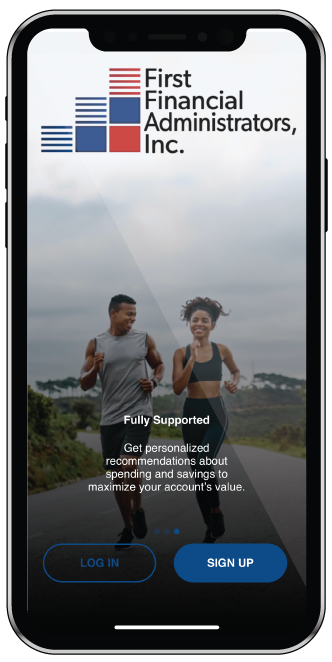

Online Wealthcare Portal

Flexible Spending Account and Health Savings Account participants can log in to their online wealthcare portal to access account balances, check on claims, upload receipts and access other account details. You can also register for an online account if you do not currently have access.

Retirement Plan Information

Click the link below to access information specific to your employer’s retirement plan. There you’ll find plan summary options, forms and due dates, and requirements for exchanges, rollovers and distribution requests.